WHAT WE DO

Frictionless outsourced accounting delivered with care. We’ll earn your trust.

We offer fully outsourced accounting so you no longer need to train and retain your own accounting staff. Whether it is executing the daily grind, closing your books or creating insightful financial reports — we have your back!

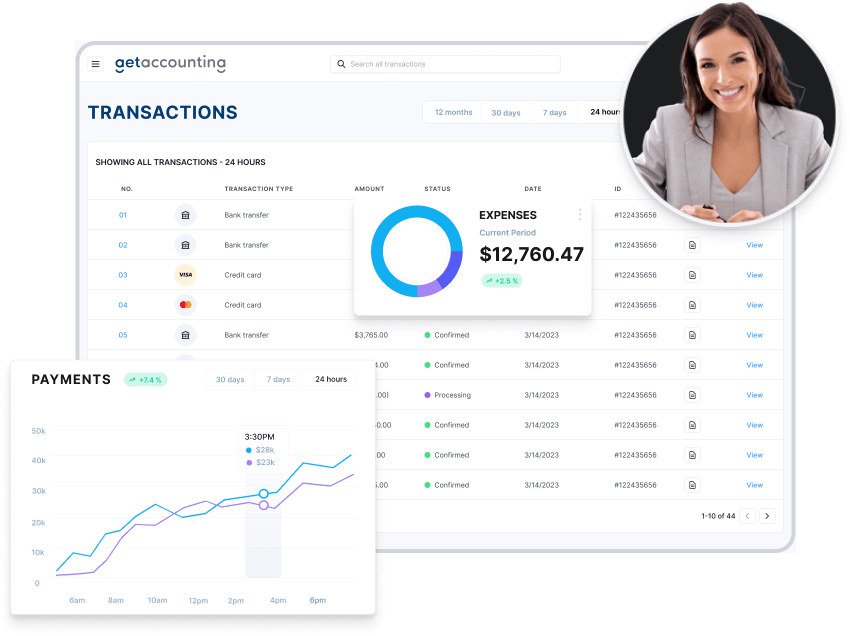

DAILY ACCOUNTING

Imagine a world where your focus is strictly your customers. Yeah we can make that happen!

First, let’s get rid of your daily headaches. Much of that is keeping track of revenue (AR) and costs (AP). Our dedicated accountants are on your team and make it all happen seamlessly.

General Accounting: GA recognizes that our clients incorporate best-of-breed applications to manage customer and/or vendor-facing interactions in addition to the core accounting system. We import data from these adjacent business systems and build transformations so that data is posted to the correct GL account. We also import data sources necessary for bank, credit card & payment reconciliations.

Revenue Management: We manage the back-office aspects of the order-to-cash cycle. After revenue has been booked, we post revenue transactions into your accounting system and collect revenue through A/R management.

Expense Management: We manage the back-offices aspects of the procure-to-pay cycle. We process vendor invoices as well as employee-related payroll expenses. Many clients use a separate payroll system and we import employee salaries and expenses and post them to the correct GL accounts.

PERIOD CLOSE

Let’s take the drama out of closing your books!

Closing the books can be hard when the right things haven’t happened throughout the month, quarter, or year! Our daily stewardship includes keeping up with things like prepaids and amortizations as they happen. We move closing the books to a set of verifications and minor adjustments. We layer in bullet proof task management so that nothing falls through the cracks.

While there is no “right sequence” for closing the accounting books, proper sequencing reduces internal looping and back-tracking. We:

-

- Reconcile the cash and payment position so that all sales and payments are accounted for in the revenue account.

- Perform an initial trial balance to reconcile A/P and A/R and to find obvious misclassification errors.

- Account for revenue timing to finalize revenue recognition

- Adjust expenses to account for accruals and deferrals

- Make balance sheet adjustments to account for depreciation, amortization, write-offs, equity contributions, etc.

- Close out temporary accounts to get ready for the next period daily activities.

And rest assured we tailor our close to your specific business

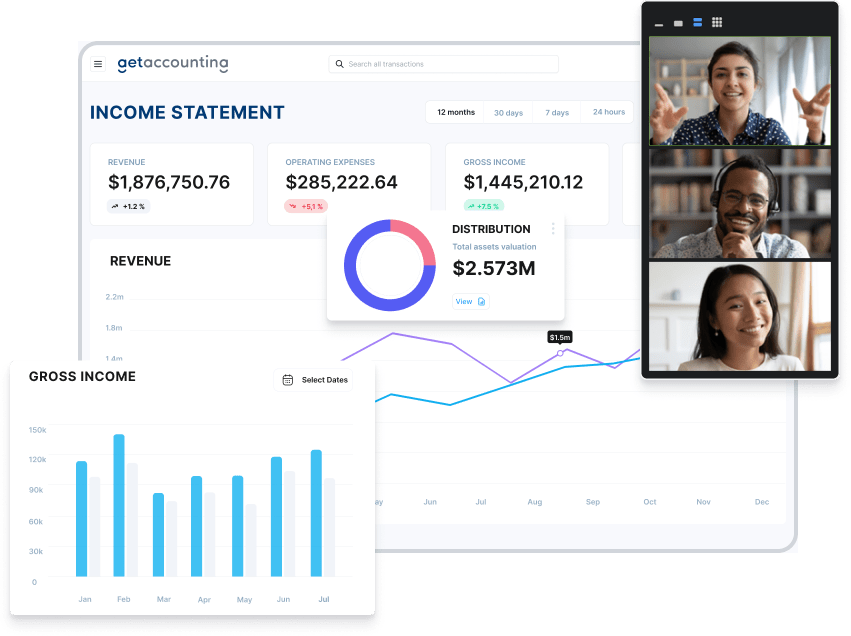

FINANCIAL REPORTING

Financial reports are the window into the health of your business.

Your financial reports are only as good as the underlying data. Our comprehensive approach to accounting operations ensures the integrity of your data and the accuracy of your reports. All of our reports are delivered with period-to-period trends so you can identify and remediate small problems before they become end-of-the-year headaches.

We create the “big 3” for all of our clients:

-

- Income Statement: This statement helps you evaluate your financial performance, plan budgets, and make decisions about whether revenue and expense trends are favorable or action is needed

- Balance Sheet: Quite simply this is what you own and what you owe and gives insight into how much leverage is available for investments

- Cash Flow: Liquidity is what sustains the business. You need to know your cash position so that you are in a postion to pay your employees and creditors.

We layer in specific reports depending on each client’s priorities. Typically, they include month-to-month fluctuations, A/R aging and much more. We are here to help you run your business and instill stakeholder confidence